The Paradox of Gen Z

Addressing the one question we get over, and over, and over again on Gen Z

Part One: Origins

The following are titles of real articles published JUST in the last month about Gen Z:

“Gen Z favors brands that support mental health, sustainability, and equity”

“Gen Z Expects Brand Action On Sustainability”

“Gen Z shoppers prioritize influencer recommendations and sustainability in clothing purchases”

And many, many more follow…

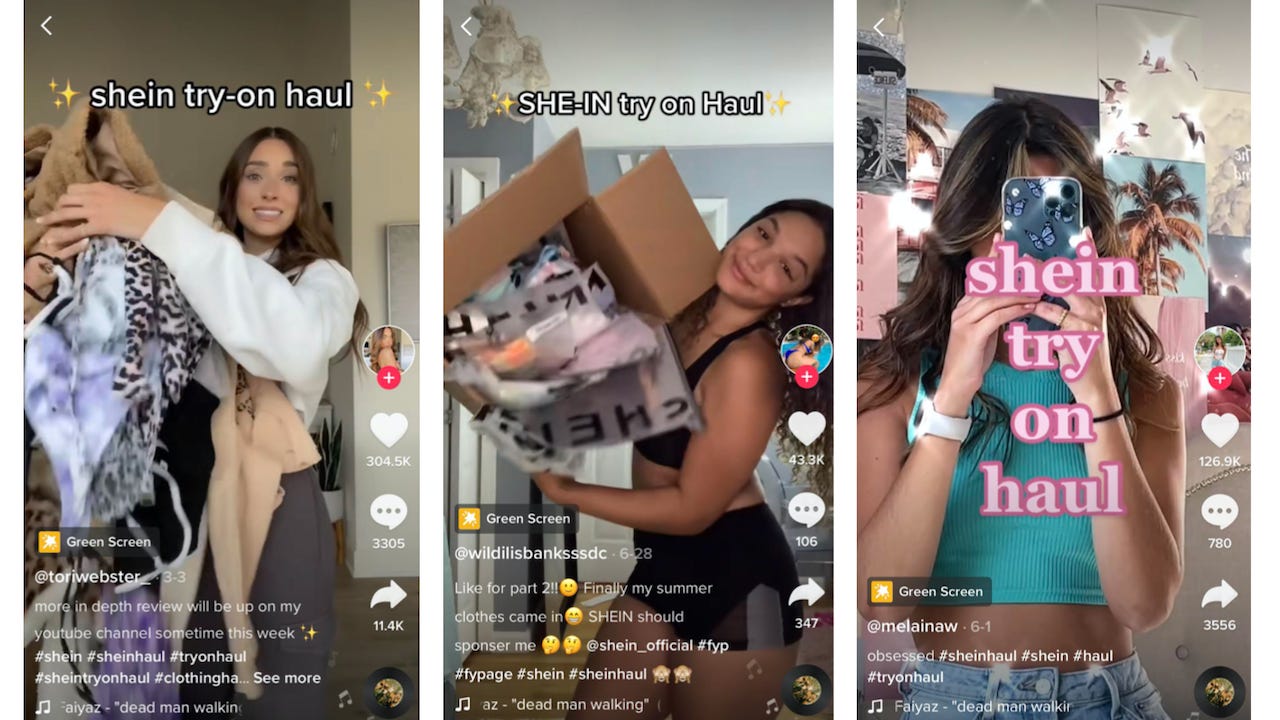

Yet we know, in addition to these preferences for sustainable brands and value-driven companies, Gen Z’ers are also the driving force behind the fast fashion boom of companies like SHEIN, Temu, Zara + more. And by the way…SHEIN has no signs of slowing down. From Jan 1 to July 12, 2023, #shein has been viewed nearly 18.6B times, with 4B coming from July 2 to July 12. For the record, #nike has 17.7B views so far this year.

So by far, our most Frequently Asked Question as Gen Z experts is:

Why do Gen Z’ers talk about the importance of sustainability and values, while also buying en masse from SHEIN + others that directly contradict that?

For a long time, the answer was simple but still gray: Yes, Gen Z is commonly considered the most value-driven generation ever when buying from a brand. And yes, we also know for this generation that cost and convenience will almost always outweigh a brand’s societal impact…at least in some industries.

Understanding this troubling dynamic became almost an obsession for our team; when does this trade-off happen, for what brands, in what moments, and most importantly…why?

And thus a central question was born that sparked some deep curiosities:

How might we truly understand the relationship between a brand's perceived societal impact and purchase intent?

How do we know which brands get free passes and which ones face real scrutiny? And what is the difference between the two?

Part Two: Breaking Down Impact

As the saying goes, perception is reality.

While we can confirm through research into annual ESG reports that some brands have more positive or negative impacts than others, we also know not every consumer is digging into annual ESG and impact reports to investigate where their dollars are going.

So for a generation with incredibly short attention spans that may not be diving into the details, where is this perception being constructed?

Our team broke perception down into three different buckets:

Consistency

The perception from consumers that a brand did, does, and will have a positive impact on society. The three temporal elements of this metric make up a measure of consistency over time. The more consistently a brand has been recognized by the audience for its impact, the higher the perception of the brand's overall impact.

Integration

The association an audience has of your brand with specific causes. The higher the association, the more successful your brand has been at integrating that impact into your core business.

Intention

The perception we as consumers or users of a company have of the company's intentions in society.

These three buckets are then compared to one, final and important question:

How does this influence purchase intent?

Because of what we know about the trade-offs Gen Z’ers are making for lower costs and more convenience in the face of a negative societal impact, we decided to flip the framing of purchase intent to avoidance intent.

By looking through the lens of avoidance, we see a more honest response that reveals a meaningful truth about their relationship with a brand and its correlation to their perception of impact.

Using these framings to break down the original question, we can definitively understand the (financial) impact of (societal) impact…or as we’re calling it, The Force of Impact.

The Perception-Avoidance Quadrant

If you know us at dcdx, we are all about unlocking new perspectives and solutions with different uses and approaches to research and data collection.

With the breakdown of impact above, we designed a survey that enables us to quantify The Force of Impact on a 2x2 with any audience.

Welcome to the Perception-Avoidance Quadrant:

To populate the Perception-Avoidance Quadrant, we surveyed an audience of 500 Gen Z’ers aged 18-24 in June of 2023 that indicated they were both a) active consumers in the fashion industry, and b) were familiar with SHEIN and what they sell.

Here’s what we found:

Past, Present, and Future Perception of SHEIN’s Impact:

On average, Gen Z consumers had a nearly neutral perception of SHEIN’s impact in the past, and present and a neutral confidence of their future impact.

This was a bit shocking, considering the framing around SHEIN in the media. But this begins to make a lot more sense as we explore Integration…

Prompted and unprompted cause associations

While there were a considerable amount of callouts related to fast fashion, child labor, and environmental harm, the majority of respondents associated SHEIN with positive values - affordability, and accessibility.

While SHEIN may be causing harm to the environment and inducing harmful labor conditions, it is also giving young people an opportunity to look good and feel good at an affordable price.

And while this may not be the absolute meaning of “social impact” to corporations, it very well may be considered the “social impact” that Gen Z’ers are associating with this brand.

Let’s look at the last factor…Intention.

Perception of Company Intent and Avoidance Intent

The most negative perception toward SHEIN from Gen Z’ers was surrounding the intentions of the company. This is perhaps a reflection of the generally anti-capitalist mindset shared by many Gen Z’ers, but when compared to the responses towards brands like Nike and Patagonia (to be released soon) we certainly see this response stand out as particularly negative.

These three different forces all end in the Perception-Avoidance Quadrant, where SHEIN falls as…

Perception-Avoidance Positioning: SHEIN

SHEIN’s audience ultimately scored it with an overall negative perception but also ranked their avoidance of the brand as low.

This places the audience in what we call the “Transactional” box - indicative of the relationship the audience has with the brand. There are no strong values or beliefs tying the audience to the brand - convenience, and cost are keeping people non-avoidant, but we believe this means the brand is susceptible to losing ground.

As perception weakens, avoidance may grow.

The data here was also collected before the RICO suit against SHEIN. Perhaps that changed the perception and subsequent avoidance - but how long would that shift last, and how much would it shift? This is what we’re calling event diffusion - the timing and strength of the spread of an event’s impact on audience perception.

Takeaways and conclusion

In today’s culture, fear holds an influential seat in the boardroom.

Fear of saying the wrong things, fear of cancellation, fear of losing customers. Fear of being the next Bud Light.

For Gen Z, these fears run rampant. Fear of being late to a trend, fear of not seeming cool, fear of missing out on an opportunity. As the speed of culture continues to increase, these fears loom larger.

Fear thrives in the unknown.

And it is the unknown of young consumers today that grows increasingly mysterious with each new event, new campaign, and new product.

There will never be a magic formula for marketing to Gen Z.

Each brand has a unique audience, with unique behaviors and influences driving unique consumption choices.

And the best we can do to conquer this fear is to learn.

To investigate, empathize, and immerse ourselves in the emotions, the vibes, and the lives of our audience.

“Knowledge is the antidote to fear”.

-Ralph Waldo Emerson

Loved this I also published recently about gen-z. Found very similar insights!