🍋 Where Starry Went Wrong

Lessons on Launching a "Gen Z" Brand: PepsiCo's launch of Starry gives us an invaluable lesson in what it takes to win over Gen Z.

In January, PepsiCo launched Starry, their new beverage replacing Sierra Mist with a hyperfocus on Gen Z. Starry is a “purpose-driven brand built for Generation Z”, with the Gen Z-focused tagline “Starry hits different”.

What was the brief? Launch a brand that speaks to Gen Z; their taste preferences, their aesthetics, and their multicultural identities. Greg Lyons, CMO at PepsiCo North America said: “With one product dominating the category, consumers deserve another option … one that hits different. Starry is bright, optimistic, and rooted in culture and fun”.

It seems that brands today try to reach Gen Z with a very targeted focus. And that certainly makes sense, right? We want Gen Z consumers, let’s make the brand appeal to them in every way we can.

But perhaps Starry shows us exactly why this may not be the case - and why this approach highlights a fundamental misunderstanding of Gen Z.

1. How has Gen Z reacted to the launch?

Despite securing partnerships with the NBA, WNBA the G League, and more (I was on a flight and they had it available a few days after the launch), Starry is not generating quite the enthusiasm with Gen Z that Pepsi may have hoped for.

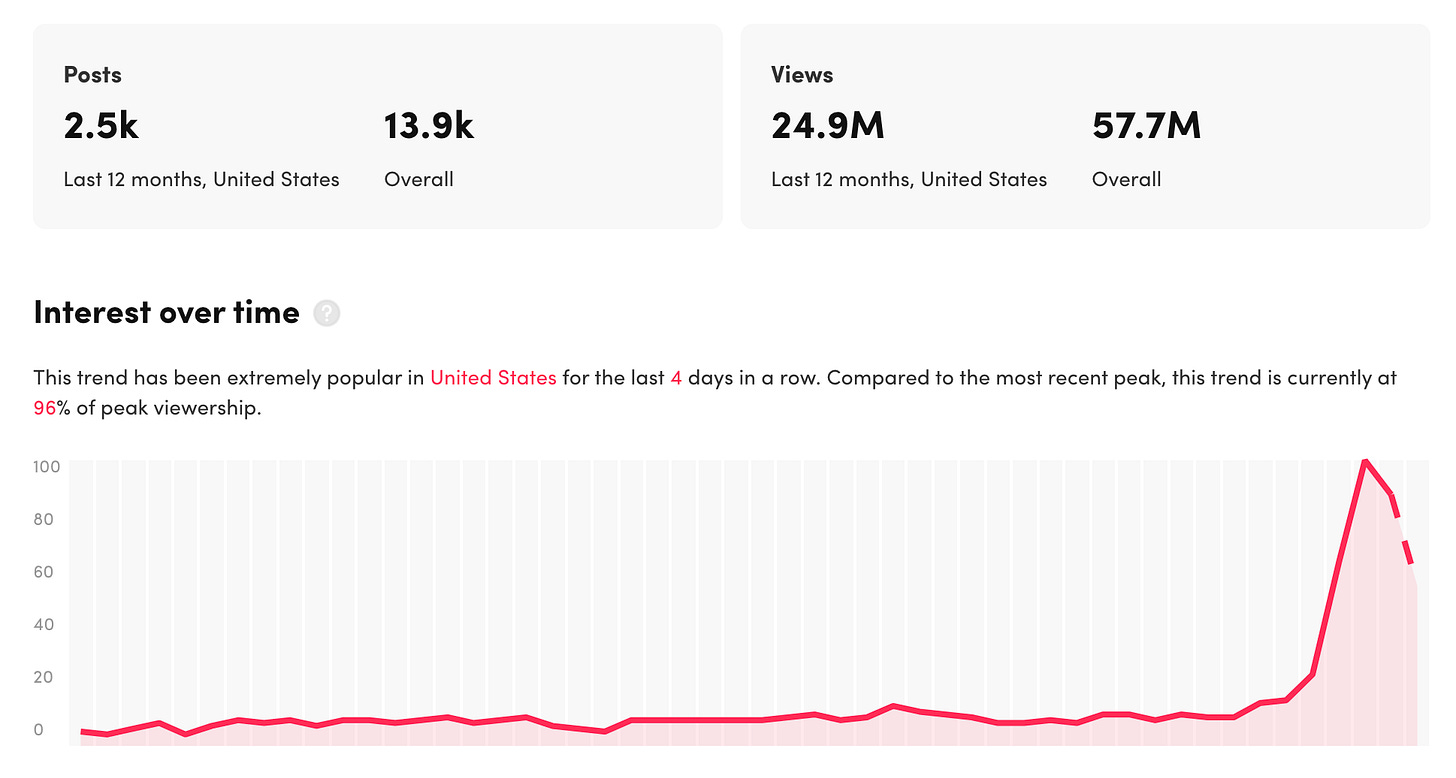

And while the brand saw some initial traction on TikTok, conversations are quickly slowing down. This graph shows the relative frequency of views over the last 12 months for #starry on TikTok.

Olipop also had a bit of fun with this launch, with their Co-Founder speaking up on 2 seemingly overlooked elements of the brand’s launch; very high sugar content and plastic bottling, two things that certainly do not align with Gen Z consumer preferences.

2. So where did Starry go wrong?

Sure, Olipop’s co-founder is right. Lots of sugar and bottles are not Gen Z-friendly. But we know that Gen Z tends to exhibit some contradictory behaviors when spending on brands. The SHEIN paradox (eco-conscious yet SHEIN-obsessed) is just one example, but even within CPG we see more relevant examples. Gatorade, with all of its sugar and plastic, is still a favorite Gen Z brand. Coca-Cola is no different.

So yes, we can debate factors like colors, taste, packaging, and health. But these miss the larger issue at play.

Why did Gen Z not latch onto Starry?

To answer this, we need to take a look at some of the major trends and signals in culture today. Last week, we wrote about #corecore - the trend that took over TikTok. Quick recap: #corecore is a TikTok aesthetic of roughly edited clips compiled into videos that draw out deeper, “core” experiences and emotions. The roots of the trend are anti-industrial and anti-capitalist; best seen - and felt - through this video here.

What is felt so powerfully in the video is the acceleration of culture; as technology grows more prevalent, the video speeds up, continuing to move faster and faster, until the very end, when the headphones are removed, and there is silence. About #corecore, we wrote:

The #corecore trend is an attempt by young people to get out of the seemingly inescapable black hole that is capitalism.

It is a scream, a cry for help from our country’s youth, an expression of anger and frustration with no outlet besides the one thing causing that very frustration itself.

Ok. So what’s the connection? Does Starry not feel and taste like the 90s? Does it not echo and satisfy those strong nostalgic longings that Gen Z is so commonly known for?

The problem with Starry is in the approach itself; not the execution.

Starry feels like it is made for Gen Z. Because it is.

But that is not truly what Gen Z wants.

Yes, Gen Z wants your brand to speak to our preferences and resonate with our behaviors.

But what is clear to marketers about Starry is also blatantly clear to Gen Z. The brand was designed for Gen Z, to be bought by Gen Z.

“Starry hits different”, bright and loud Gen Z colors… it screams Gen Z to Gen Z too.

Amid the rise of de-influencing, #corecore, and further signals that point to a rejection of culture’s capitalistic acceleration, Starry - despite doing nearly everything right to reach Gen Z - has missed one core, fundamental truth that speaks to every generation of consumers:

Nobody wants to be sold to. And particularly not Gen Z.

3. What do we know about brands that do speak to Gen Z? Or make Gen Z speak…

In Q3 of 2022, we launched the Gen Z CPG Brand Magnetism Report; a ranking of 40 CPG food and beverage brands based on their Brand Magnetism; their ability to attract popular and consistent user-generated content online.

In a MediaPost feature, we discussed “How Older Brands Stay Relevant to Gen Z”, highlighting the mix of novelty and nostalgia that drive so much conversation in the CPG space from young people.

We share this not to be a self-promoting piece - again, nobody likes being sold to - but because the methodology we use highlights the disconnect between brands and consumers today.

When we look at user-generated content, what we measure is unprompted, organic conversations that emerge online from young people. We look at how young people use their platforms to share their voices, and how much the content they create resonates with others (hence popularity and consistency).

And what we get as a result of this is a different story than the one told many times by the media.

That despite the newsworthy conversations - the new product launches, the sexy campaigns, and big metaverse activations - there is more between generations that stays the same than changes.

The brands that win the hearts and minds of Gen Z are not exclusive to them or explicitly targeted at them. Gen Z gravitates towards brands that are firm in what they stand for, and unwavering in their commitment to the infinite game; where the objective is not to win - it is to keep playing.